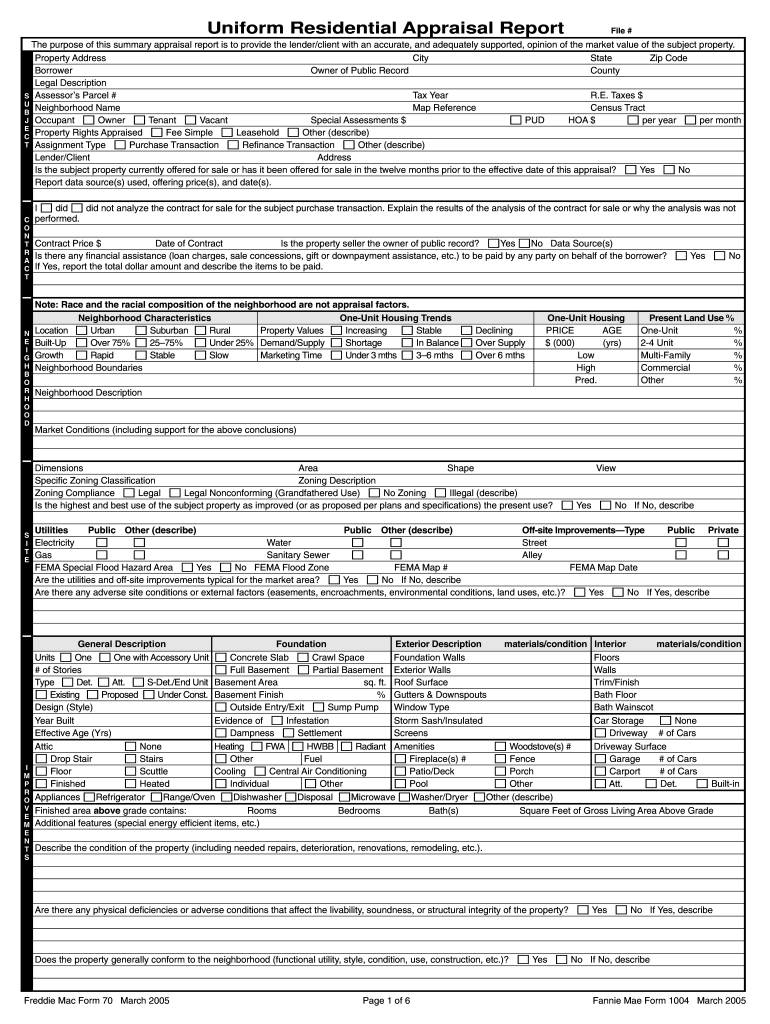

Who needs a Uniform Residential Appraisal Report?

A private property owner fills out the report to provide the lender/client with an accurate and adequately supported opinion of the market value of the subject property. The intended user of this appraisal report is the lender/client.

What is the Uniform Residential Appraisal Report?

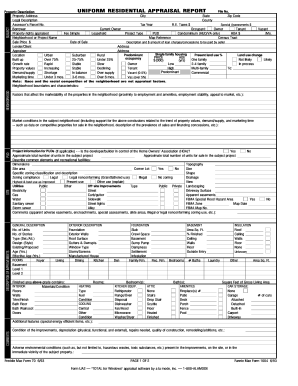

The Uniform Residential Appraisal Report (URAL form or Fannie Mae 1004 form) is one of the common forms utilized for real estate appraisal. It was created for analysis of conditions and evaluation of single-family dwellings or single-family dwellings with an “accessory unit” (including a unit in a planned unit development) but is not meant to be used for appraisals of manufactured homes or condominiums. Lenders will apply for the report each time a property is purchased or refinanced. All information provided in the report is used to appraise the actual value of the property.

Is the Uniform Residential Appraisal Report accompanied by other forms?

The fillable appraisal form is not accompanied by any other forms.

When is the Uniform Residential Appraisal Report due?

While you may never see an expiration date on a real estate appraisal forms, many lenders will not accept an appraisal that is more than 120 days old because the property values are changeable.

How do I fill out the Uniform Residential Appraisal Report?

There are several boxes you will need to fill out in the Uniform residential appraisal form: 1) Property Description; 2) Neighborhood and PUD (an overview of the history of that particular area); 3) Site (covers the property specs); 4) Value; 5) Final Determination.

The report requires interior and exterior inspection of the subject property, a street map that shows the location of the subject property, an exterior building sketch of the improvements that indicates the dimensions.

Where do I send the Uniform Residential Appraisal Report?

The Certified contract must be sent to the client/lender.